💵 Cash: How Much To Keep + Where To Put It (+ Timely Southwest Companion Pass Q&A)

👋 Hi all, Chris here! We just hosted our biggest Thanksgiving dinner yet (14 people) and I hope you all had a wonderful Thanksgiving too. This email is a deeper dive into one topic than normal, so I’d appreciate hearing whether you’d like to see more (or less) like this in the future. Hope you enjoy!

Also, last time I mistakenly sent the wrong description for my episode with Logan Ury. She’s a bestselling author who joined me to discuss the science behind successful relationships. It was a phenomenal episode that I hope you’ll listen to here. Sorry Logan!

💵 Why Hold Cash?

I try to invest as much of my money as I can in the market because I’m a huge fan of compound interest and am focused on building my wealth. Personally, I keep my long-term investments at Wealthfront, where the 5-year return for a 9.0 risk score portfolio has been 11.94%

1. However, the market can be volatile… that same portfolio would have been down by over 30% in just a few months in 2008 and 2020, but since those lows, it would have recovered and been up by ~400% and ~180% respectively. The key to benefiting from those recoveries was not having sold when you’re down and since I never know when the market might be down, I keep some money in cash for three reasons (I’ll talk about how much I keep in each later):

- Regular expenses like mortgage, groceries and credit card bills

- Emergency funds in case something large and unexpected comes up

- Savings for big expenses in the next 3-5 years like a downpayment

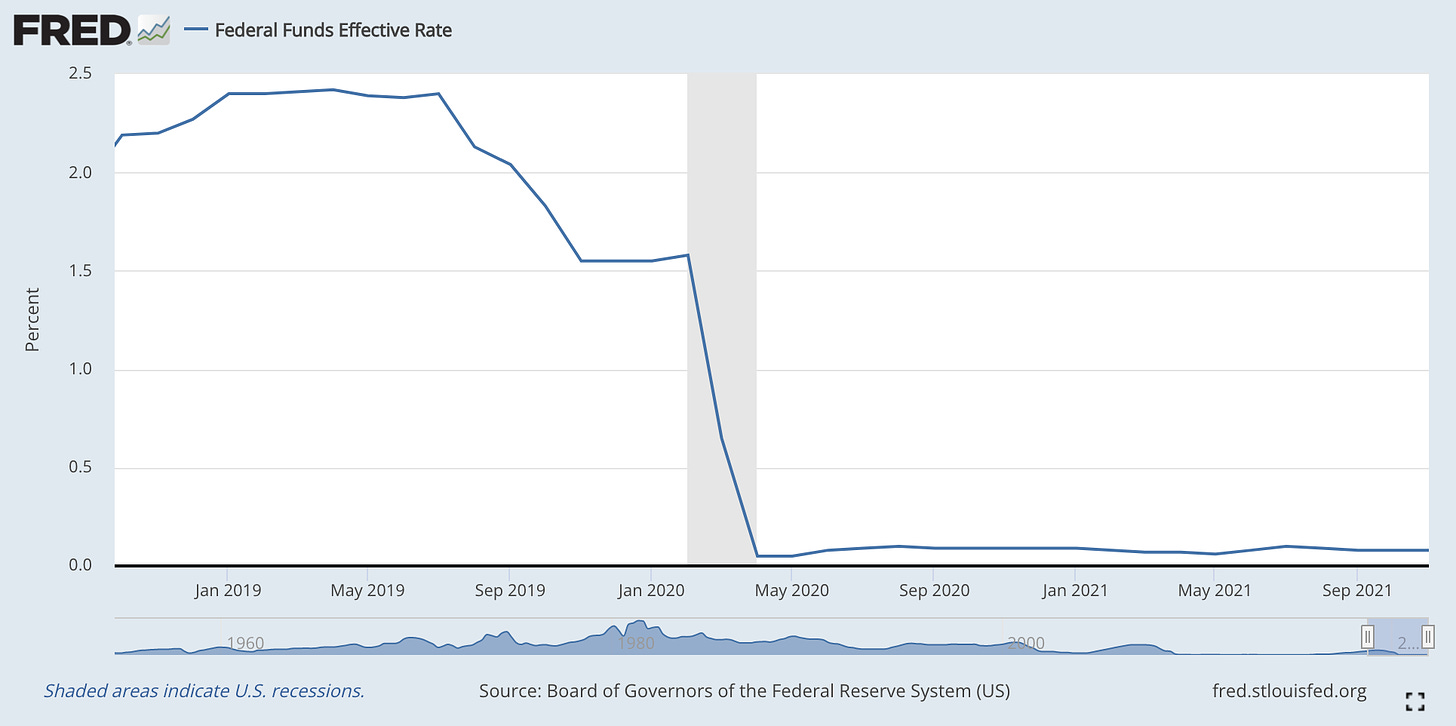

While I keep cash for regular expenses in my checking account where I don’t earn much interest, I want to keep #2 and #3 somewhere I can earn the most I can. Until the beginning of 2020 there were so many high yield savings accounts paying >2% interest. That was possible because the effective fed funds rate (EFFR), which is the average rate banks lend and borrow funds to each other, was above 2% for all of 2019.

|

Last 3 Years Fed Funds Rate (source)

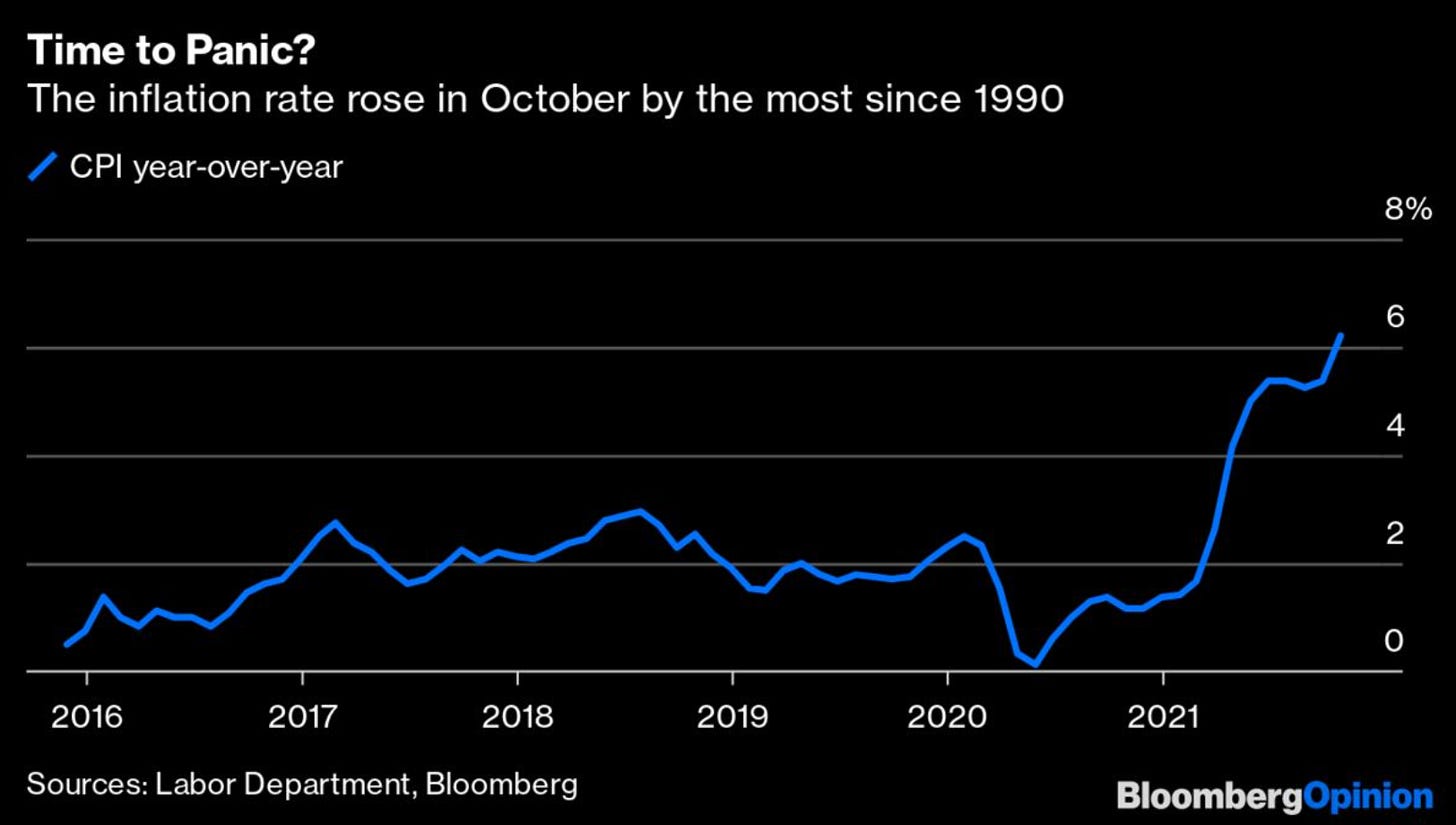

That all changed in 2020 when the EFFR dropped to 0.05% (and hasn’t risen above 0.10% since), which meant that top online banks had to drop their rates and are now only paying 0.10-0.50% APY in their “high yield” savings accounts. That’s not just a problem because we all want to be earning more, it’s a problem because inflation (the increase in prices) is on the rise, hitting 6.2% in October (the highest level since 1990).

|

🏦 Where to Put Cash

So where do you put cash? I don’t want any restrictions on the account I use to pay bills each month, so I’m ok living with a low or no interest checking account. But where does the rest of the cash go? Here’s where I put my cash, along with one new option I’m considering:

- Crypto Interest Accounts: Many crypto products have popped up here in the past few years, but the BlockFi Interest Account has now become the primary place I store cash. My deposits are automatically converted to USDC stablecoin and earn 9% APY accrued daily and compounded monthly. If you’re like me, you might wonder how this is possible. They generate interest by lending out your deposits to borrowers and because most large financial institutions aren’t tied into this ecosystem to lend money (similar to the cannabis industry) the rates are much higher. While most loans are overcollateralized, these accounts are not FDIC insured, so I would consider it higher risk than a traditional bank. However, despite multiple big crashes in the crypto markets, my account hasn’t been impacted once so it remains my primary place for cash.

Note: Since publishing this newsletter BlockFi has restricted customer withdrawals and the money I have there is not accessible. I can no longer recommend BlockFi and only hope that the situation is resolved and money is available to account holders. - AA Miles Savings Account: Bask Bank offers an FDIC-insured savings account, but instead of paying $ interest, they pay American Airlines miles at a rate of 1 mile per dollar per year. With AA miles valued at 1.4¢ that’s an effective APY of 1.4%, but here’s the kicker: for tax purposes, Bask only values AA miles at 0.42¢, so if you assume a 35% marginal tax rate you could argue that the effective APY is 1.93% because you’re paying less taxes. I like having some miles with every airline and AA isn’t a transfer partner of any major credit card program, so I always keep some money at Bask to help boost my AA balance. However, keep in mind that if you don’t already have some AA miles you’ll probably need to keep at least $10,000 in this account to earn enough miles in one year for the cheapest award flights (e.g. one-way domestic).

-

Investing and not holding cash: This is a controversial one, so hear me out. Almost all of my long term investments are at Wealthfront, where I can take a PLOC loan against my portfolio for 2.4%. I also hold a few stocks at Interactive Brokers who offers the same option at 1.07%. Now, borrowing against your portfolio has a few major risks to call out: 1) your interest rate isn’t fixed and might go up at any time and 2) if the value of your investments falls significantly, you may receive a margin call and have to repay some of the loan to meet your equity requirements. However, if the amount you need to borrow is a small fraction of your portfolio, it’s much less likely that this will happen (example below). So, for short term needs during a low interest rate environment, where you have enough in your investment account that you’d need to borrow a small percentage of your portfolio, this might be a viable alternative to cash. For me, it’s replaced holding a large emergency fund in cash.

- Example: If you had $100,000 in a Wealthfront portfolio and borrowed $25,000, you wouldn’t need to make a repayment unless your portfolio dropped ~60% to $40,000, which I don’t think has ever happened in my lifetime for a globally diverse passive index fund portfolio.

- High Yield Savings: Yes, they might not pay enough interest to beat inflation this year, but they’re FDIC insured and the safest place to put cash. I only keep a small amount in a few of these accounts to ensure the account isn’t closed, in hopes that interest rates rise again soon. The bank with the best rate changes almost daily and most comparison sites prioritize whoever pays them the most. I think the best place to find the banks with the highest rates is Doctor of Credit. Two important things to keep in mind: 1) an extra 0.1% on $10,000 is only $10/year, so depending on your balance it might be better to focus on whatever bank is most convenient or offers the features you need (e.g. Wealthfront makes it fast to transfer to my investment account and Ally makes wire transfers easy) and 2) you don’t earn interest while your money is in transit, so chasing the best rate might actually hurt you (explained in more detail here).

- LifeGoal ETFs: I’ve always struggled with giving friends a recommendation for an easy place to save for goals like a downpayment that keeps up with inflation but isn’t as risky as putting it all in the stock market. I recently came across LifeGoal Investments and am intrigued by their model. They offer a handful of ETFs, each designed specifically for goals like a child, downpayment or vacation. But most interestingly, a big part of the stock allocation in each fund is invested in companies they found to be correlated with that specific goal. For example, the largest holdings in the home downpayment ETF are Lowe’s, Home Depot and Zillow, which they hope will all be correlated with home prices and thus help your portfolio grow more if housing prices rise. They’re not a sponsor and I haven’t done enough research to endorse them, but it’s something I was excited to check out.

📊 How Much Cash To Hold

Using the three reasons I mentioned at the beginning of this email, here’s how much cash I hold for each:

- Regular expenses: I typically only keep ~2x my average monthly spending in cash, however, my spending has been fluctuating quite a bit recently with a big family holiday trip and furnishing our home, so I’m now keeping a larger buffer (~4-5x monthly spending) of cash in my checking account. In a few months I hope to get back to ~2x and invest the extra cash.

- Emergency funds: I like to make sure I have easy access to 6x my average monthly spending without selling my investments. However, as I mentioned earlier, I’m comfortable relying on a portfolio loan for emergencies, so I’m not currently holding any cash for this purpose.

- Short Term Goals: This amount is entirely dependent on the major expenses you have planned in the next 3-5 years. For me that includes a downpayment for a new car next year, the au pair agency fee we’ll owe in January and some planned expenses for All the Hacks. I keep ~90% of this money at BlockFi and 10% at Bask Bank.

I hope all this was helpful, but I’ll be doing a Q&A episode on money, savings and investing soon, so please send any follow-up questions (or really any questions) my way by just replying to this email.

🛫 Earning Southwest Companion Pass

Many of you have written to me with follow-up questions about how to use the Chase 100k Southwest Card signup bonuses to earn companion pass free for two years. I had hoped to include this in my upcoming points Q&A episode, but the credit card offers expire next Tuesday (12/7), so I wanted to include all my thoughts here sooner.

What is a Southwest Companion Pass?

Southwest’s highest status, Companion Pass, lets you name a person who can fly free any time you purchase a ticket (even if you pay with points). It works for the calendar year you earn it AND next year, so the earlier in the year you earn it the better. Finally, you can change your companion up to 3 times each year.

What are the requirements to earn it?

You need to earn 125,000 Southwest points, which if you’re only earning points from cheap fares, would require spending over $20,000 on flights. However, points earned on Southwest credit cards (including signup bonuses) count towards this goal, which makes it MUCH easier.

What’s the hack to earn it quickly?

Until 12/7 Chase is offering a 100,000 point signup bonus on each of the three Southwest credit cards. If you want to signup, I’d appreciate you doing so at allthehacks.com/cards. You’ll need to spend $12k on the card to get the full 100,000 points, which will actually get you to 112,000 points (technically it’s $2k for the first 50,000 and $10k more for the next 50,000). From there you can do any mix of credit card spending and flying to get the final 13,000 points. The timing is important, so make sure to read the next question.

How do I not mess this up?

The biggest way you can mess this up is earning any part of the signup bonus before the end of the year, so you’ll want to hold off on spending the full $2k until AFTER the December statement closes. If you’re signing up in December this might not ever happen, but I’d consider calling just to make sure or just waiting until January to start spending money on the card.

One other consideration is that Chase only lets you open 5 cards every 24 months, so if you’ve already hit that limit, you won’t be eligible to open the card. Also, if you’ve received any Southwest card bonus in the last two years you won’t be eligible either.

How am I supposed to spend $25k?

While I know it’d be ideal to earn Companion Pass in January, $25,000 is a lot more than I spend in a month, so unless you spend a lot each month or you need to make some really large purchases at the beginning of the year, it might take you a few more months. Fortunately, you have 3 months from card approval to spend $2k for the first bonus and 12 months to spend the remaining $10k for the remaining bonus.

I don’t suggest buying things you don’t need or paying transaction fees for charges on your card, but if you have the savings to manage it, you can use gift cards to time-shift spending. For example, if you spend $500/mo at Whole Foods, you could go buy $3,000 of Whole Foods gift cards and then use those gift cards over the next six months.

🎙 Recent Episodes

Each newsletter I’ll highlight a few recent episodes, as well as a favorite from the archives that you might have missed.

|

#30: Memory Hacks with a World Champion

World memory champion Johannes Mallow shares the timeless techniques he uses to memorize things most assume are impossible (including a real-time walkthrough), as well as how to use these memory techniques in your personal and professional life. Thank you to BlockFi for sponsoring this episode!

| 🎧 Listen to Ep30 w/ Johannes Mallow |

|

#31: Using Creativity to Reshape Your Life and Regain Freedom

World-renowned photographer Chase Jarvis discusses how to unlock your full potential by embedding creativity in your daily life, the four simple steps you can follow to be creative with anything and how productivity is a mix of tough love and play. Thank you to BlockFi for sponsoring this episode!

| 🎧 Listen to Ep31 w/ Chase Jarvis |

|

#8: Earning 9% on Cash, Investing in Crypto and Trading Options

Crypto expert Zac Prince discusses how crypto platforms can pay up to 9% interest on stablecoins, his experience founding BlockFi, how to build a crypto portfolio, and his favorite investing hacks.

| 🎧 Listen to Ep8 w/ Zac Prince |

💭 Parting Thoughts

Thank you so much for reading! How’d you like it?

Loved | Great | Good | Meh | Bad

Your feedback will help make it great, so I’d love to hear your thoughts/suggestions. If there’s a topic you’d love me to dig into in an upcoming issue, please let me know!

Thanks for reading!

Chris

All the Hacks is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Editor’s Note: Today, I’m grateful for the support of our partners: BlockFi and UpgradedPoints. Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Chris Hutchins

Discover the latest and greatest hacks, deals and recommendations to upgrade and optimize your life, money and travel – all while spending less and saving more.

👋 Hi Reader, Happy Saturday—hope your weekend is off to an amazing start! Here's what's included in today's newsletter: 💳 Deep dive on 30+ Amex cards & Membership Rewards 🏡 Earn 50,000+ points on a new mortgage or refinance 🏦 Bank bonuses worth $4,300+ 💺 Deals on business class award flights to 7 destinations 🔗 $500+ worth of savings via card-linked offers 💳 3 New Bilt cards coming in 2026 🎁 Up to 20% off popular gift card brands 🛬 U.S. airports with summertime flight delays and more! One...

👋 Hi Reader, Hope your weekend is off to a great start! Here's a quick look into today's newsletter: 💰 My 10-step money allocation framework 🌍 Earn 1 million points by flying to 6 continents 🎯 Up to 50% off + free $50 credit at Target 🤗 Free museum tix, fitness membership, ice cream 💺 20% off Flying Blue award flights 🤩 Easy bonus miles & points: United, Marriott & Hyatt 💳 $20 off Amazon with Discover cards 📈 Increased award ticket fees & taxes on Virgin Atlantic 💸 Learn to spend money and...

👋 Hi Reader, Hope your weekend is off to a great start! Here's a quick look into today's newsletter: 🏡 New card to earn points on mortgages, daycare and more 💸 What each generation gets right & wrong about money 💳 New Amex Gold & Platinum bonuses up to 175k ✈️ JetBlue promo to earn 350k points & status for 25yrs 💰 Up to 2% bonus for Robinhood crypto transfers 💺 Biz class award flight deals to 10+ destinations 🌴 Summer travel: hotel promos, bonus points, cash back 🏞️ Free National Park Annual...